Creative Industries

France’s music publishing market was worth €507 million in 2023, up 20% y-o-y

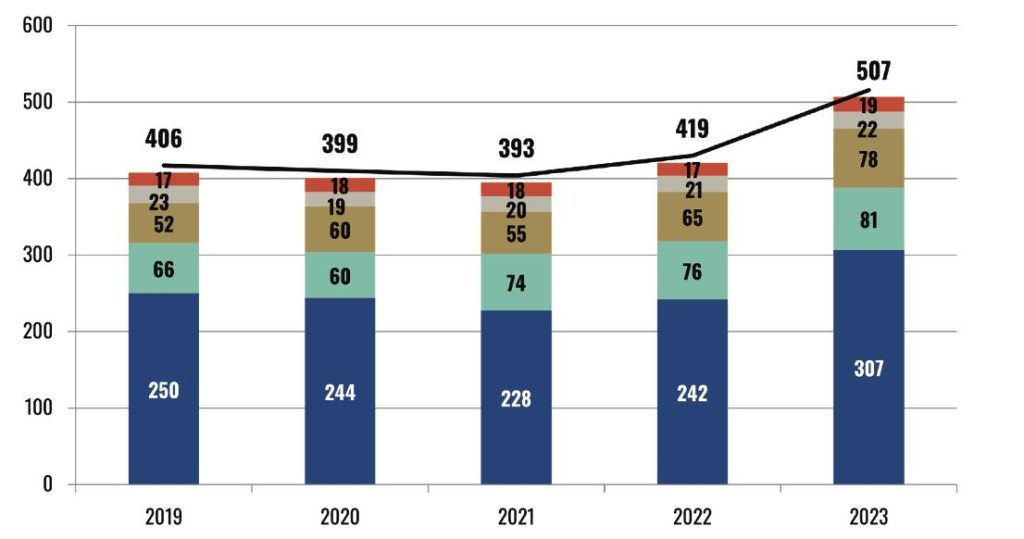

The French music publishing market posted revenues of €507 million in 2023, a 20% increase compared to 2022, according to figures released by music publishers’ association CSDEM (Chambre Syndicale de l’Édition Musicale), alongside CEMF (Chambre Syndicale des Éditeurs de Musique de France of Music Publishers of France), and ULM (Union des Librairies Musicales or Production Music Organisation). Pop repertoire accounted for 83% of the total, with production music at 10% and classical at 7%.

CSDEM’s Baromètre de l’édition musicale – Focus on Music Publishing provides the world’s most granular and comprehensive market figures about the local music publishing market in a specific country. In the report, CSDEM said the publishing business was positively impacted by a growth in digital, performance rights and export revenues in 2023, the last year for which data was available (figures do not take into consideration to potential positive impact of the Olympic Games in 2024).

At a presentation in Paris, CSDEM Chair Juliette Metz, said that all segments of the business performed well in 2023, except for mechanicals. She added that by all counts, 2024 will “also logically post growth.”

A return to growth

For Anne Jouanneau, Deputy Managing Director at Sony Music Publishing France, and Chair of CSDEM’s research commission, the 2023 figures “confirm the return to growth after the Covid years. All signals are green. We had a strong growth in digital revenues as well as in public performance royalties. In addition, international collections were very dynamic.”

The French methodology to map the music publishing market has inspired the International Confederation of Music Publishers (ICMP), especially thanks to the ongoing work done by former Sony Music Publishing France Managing Director Nicolas Galibert, who has been pushing for the organisation to build a similar data gathering project.

ICMP Policy Officer David Ocaña Páramo told CSDEM members that the international version is in the works. “The French industry is priviledged to have this work done and have such as level of granularity,” said Ocaña Páramo. “No other market does that. It is very hard to achieve.”

A global report in the works

Ocaña Páramo said the key takeway from the French experience is that there is “trust and transparency between publishers, SACEM and the music publishers’ association, and it is reflected in the survey.”

ICMP has started working on its own Baromètre, inspired by the French report, he said, admitting that it was “a complex project.” ICMP has been going through other MPAs for information and is also working with CMOs. “We are in the final stage of crunching numbers and we should produce a report soon,” said Ocaña Páramo, without giving a specific timeline.

Key takeaways from the French report include:

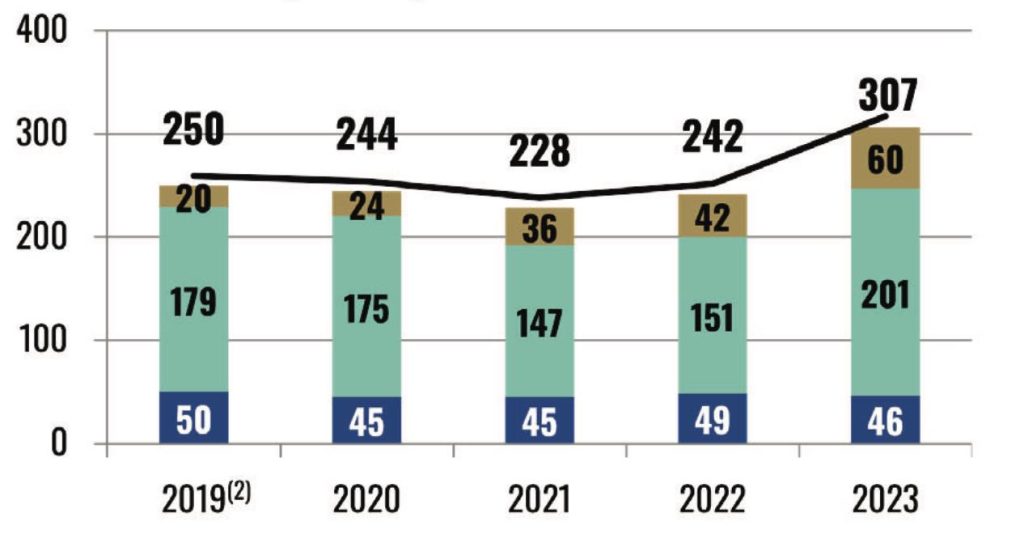

> Distributions from music rights society SACEM to publishers increased “significantly” year-on-year, with €307.0m, up 27% compared to the year prior, thanks to “strong growth in digital rights and public performance rights.”

SACEM’s revenue streams includes mechanical rights (phonographic and video exploitation, private copying*, foreign), public performance rights (live performance, radio, television, broadcasting in public places, foreign), and digital rights (streaming, downloading, mobile ringtones). It represented 61% of publisher’s income in 2023, compared to 58% in 2022.

“Public performance rights have now exceeded pre-Covid levels by over 12%,” said Jouanneau, who pointed out that revenues from the use of music in public spaces, live performances, radio and TV all posted significant growth, which she owed to a good economic climate and increased efficiencies from SACEM.

Total digital rights amounted to €129.0m in 2023, including €75.0m collected by French publishers and €54.0m million in pan-European allocations, representing 42% of total digital rights. Excluding pan-European allocations, digital rights represented 15% of the publishing market in 2023. They increased by 30% compared to 2022, driven mainly by revenues from audio streaming and SVoD.

“Digital rights have made some strong progress, thanks mainly to streaming and SVoD revenues,” said Jouanneau. “However, our transition to digital lags behind that of the recorded music side.”

2023 was a record year for revenues from SACEM, with digital rights up 42% in 2023, representing 19% of revenues from the society; rights generated by live performances were up by 57% compared to 2019 figures; and revenues from the public use of music were up by 13%, as did performance rights from the use of music by radio stations (up by 18%).

Rights from private copying and television grew by 3% and 4%, respectively between 2019 and 2023): while foreign rights increased by 12% between 2019 and 2023.

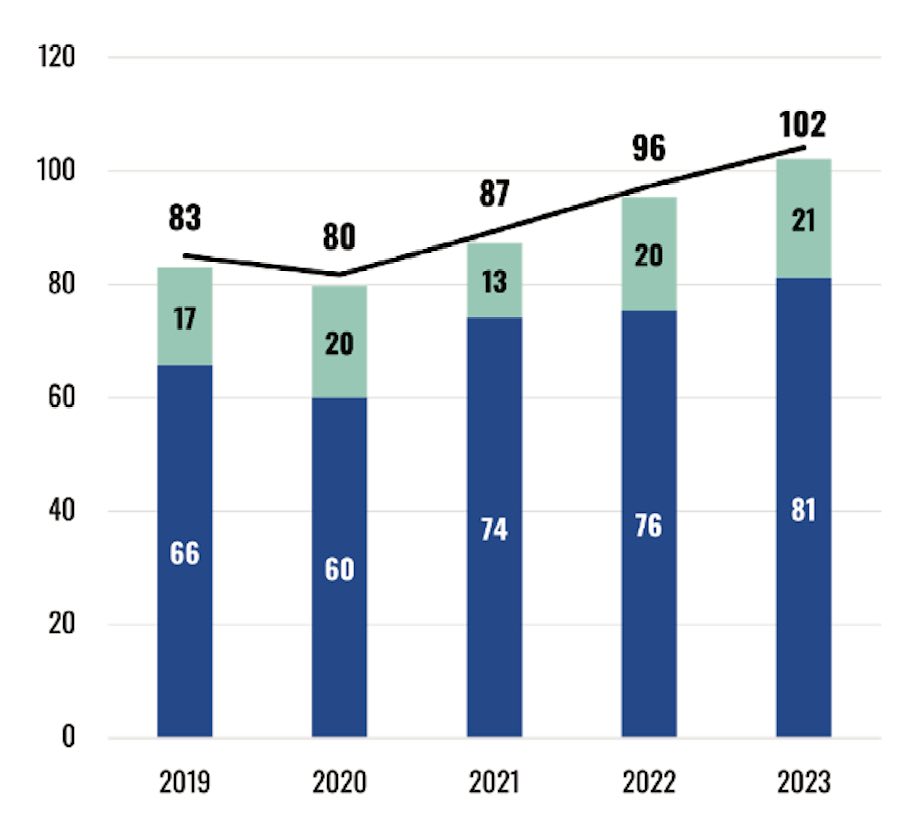

> Synchronisation rights were up by 7% to €102m, representing 16% of the French publishing market’s revenues in 2023. Synch is the leading source of revenue directly managed by publishers. ahead of foreign rights. It should also be noted that publishers hold a larger share of the synchronisation market than owners of sound recordings (€32m in 2023).

“Synch rights are a key activity for music publishers, and they are managed directly by publishers,” said Jouanneau. “They generate more revenues than digital. Publishers always find ways to enhance the value of their catalogues and synchronisation is a key tool to achieve that goal.”

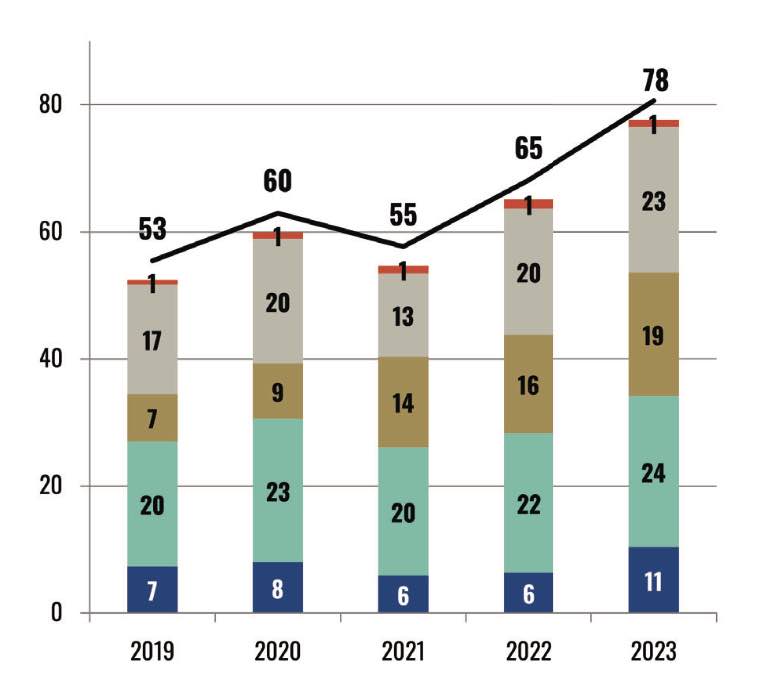

> Foreign rights were up by 19% to €78m. These rights includes revenues from domestic repertoire abroad collected by sub-publishers outside France (excluding SACEM rights). Mechanical rights recorded a significant increase (+63%), while digital rights, synchronisation rights, and public performance rights increased by 25%, 16%, and 8% respectively.

Pop music accounted for 76% of total foreign royalties in 2023 (+2 points year-on-year), far ahead of music libraries (21%, -2 points) and classical music (3%, stable). Exploitation of catalogs abroad remains a key activity for music libraries.

> Revenues specific to classical music, consisting of sales of printed music, score rentals, reprographic rights, and general rights, also returned to growth, with €29.1m in revenues in 2023, up 2.5% year-on-year, returning to pre-Covid levels.

However, now all segments posted growth: sales of printed music and method books experienced a further 5% decline in 2023 to €9.7m compared to €10.2m, and are now lower than in 2020. However, the drop was offset by a 6% increase in SEAM reprographic rights, and a 10% increase in SACEM royalties to €3.3m.

> Other rights, mainly consisting of graphic licensing fees, management fees, neighbouring rights on masters and other non-publishing revenues, increased by 12% to €19m.

A digital gap

During the presentation, CSDEM highlighted the “digital gap” affecting the French music publishing sector. Digital rights represented 20% of the rights distributed by SACEM to French publishers, compared to 37% of the rights distributed to all rights holders: authors, composers, foreign publishers, and foreign companies subject to specific pan-European agreements.

These pan-European agreements result in the collection by SACEM of digital rights from the repertoires covered by these agreements, across several territories, and the distribution outside France of digital rights collected by SACEM from the French exploitation of foreign works. CSDEM has calculated that the pan-European licensing deals resulted in €54m escaping French publishers and paid out to their parent companies.

But even if these revenues were integrated into the French revenues, digital would only represent 23% of the French publishing market in 2023. For comparison, for recorded music’s digital revenues in France accounted for 64% of total revenues. “The transition from physical to digital revenues remains behind in the publishing market compared to that of phonographic producers,” noted CSDEM.

Local works up 10.5%

This is mainly due to the fragmentation of repertoires, the effect of multi-territorial licenses (pan-European agreements), management rules specific to online exploitation, requiring in particular the implementation of documentation of the work at the start of exploitation, and the the time lag caused by collective management for the collection and distribution of rights.

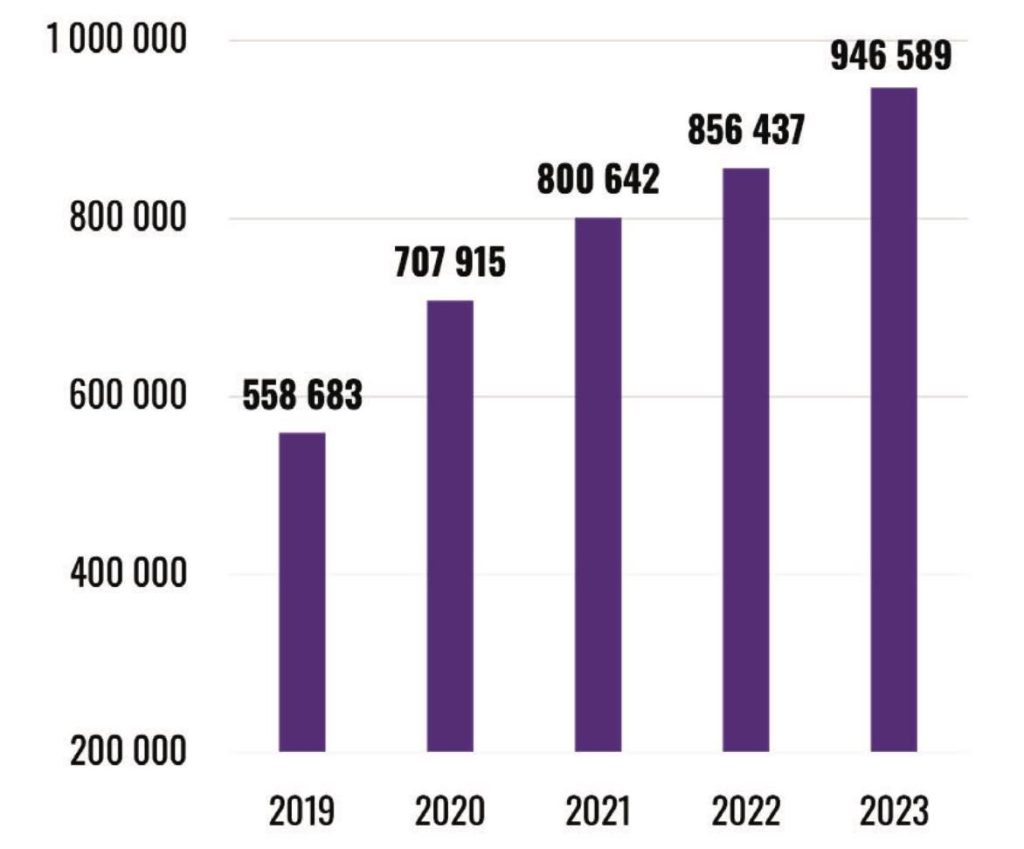

The report also provides a look at the number of works published in France. While that number has increased significantly in recent years, it posted a 10% decline in 2023 compared to 2022, but the figures are sill 32% higher than in 2019. There were 11.6 million works registered in 2023. Local works have experienced a 10.5% increase in 2023, and a 69.5% growth compared to 2019.

The report estimated that the average publishing revenue per work increased by 33% between 2022 and 2023 for all works (French and foreign combined), but decreased by 5.5% for local works. However, this average publishing revenue per work now exceeds the 2019 level.

Less signing of new talent

The number of new works published increased by 13% in 2023, reaching a total of 31,039 titles, surpassing the 2019 level. This growth was driven by established authors (+41% compared to 2022, compared to -19% for new talents over the same period). Publishers explain the drop in the registration of new works by new talent as the reflection of a lower number of new songwriters and composers signed to music publishing companies.

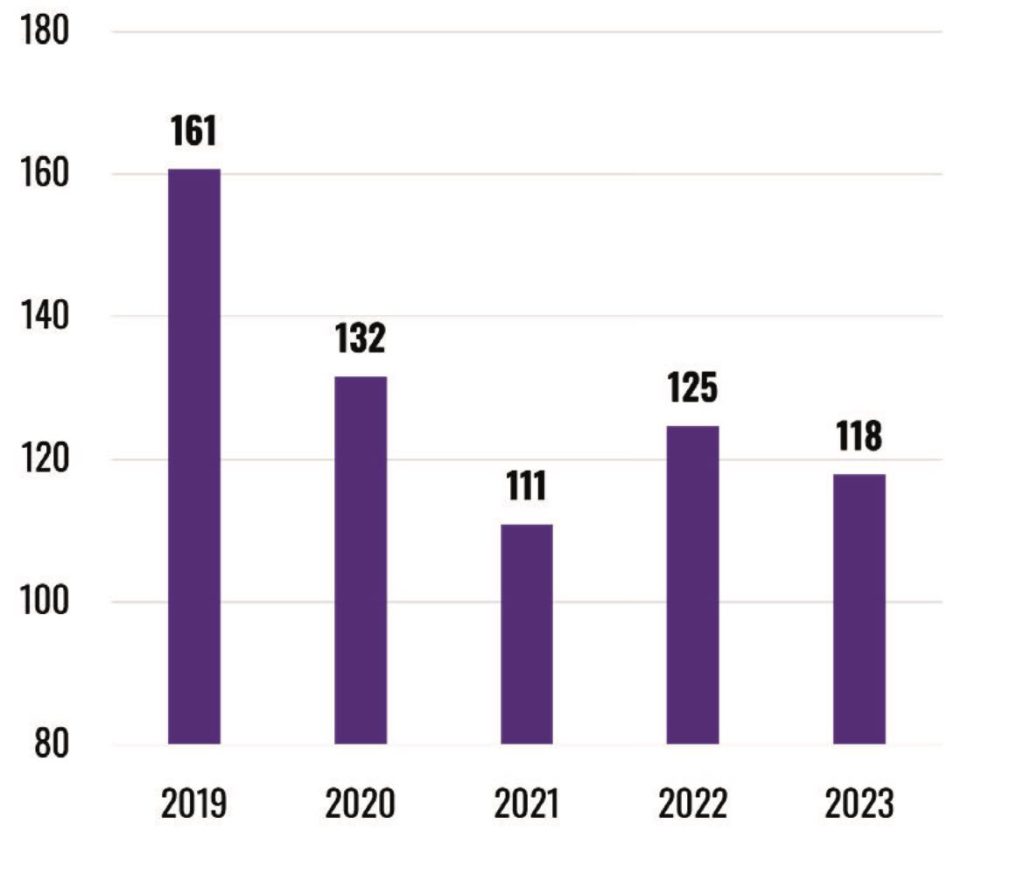

CSDEM also calculated the average revenue generated by local works. In 2023, the figure was of €118, down from €125 in 2022. However, in 2o19, the average revenue per work was of €161, a 26.7% drop in five years.

Similarly, the number of authors and composers under new contract stood at 1,336 at the end of December 2023, down 4% compared to 2022. This drop can be explained by the slight decrease in activity across all categories, with rock recording the largest decline (-23%) and the dominant urban genre also declining.

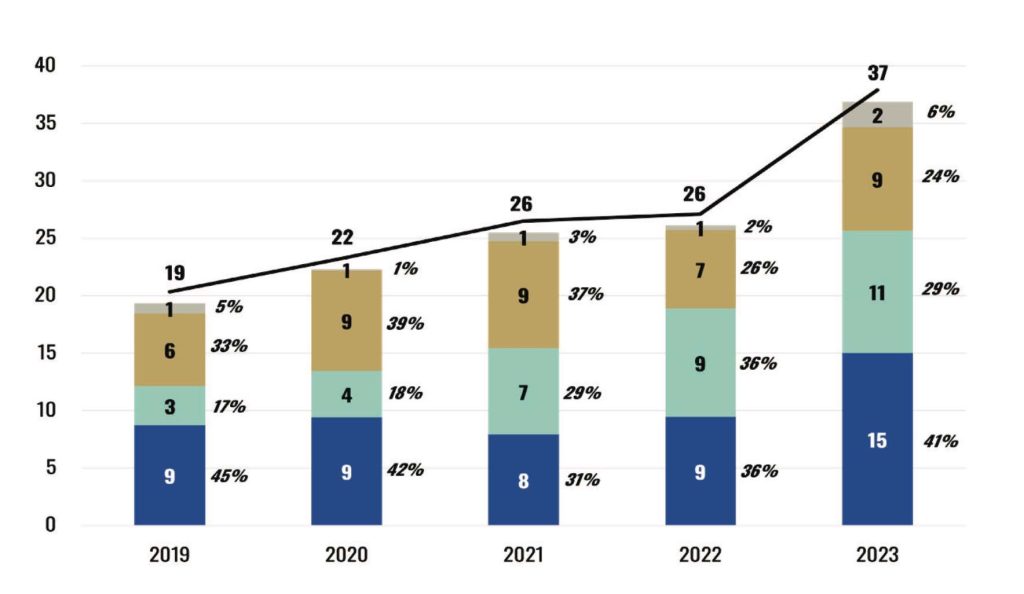

€82m in advances

While new talent accounted for 69% of contracts at the end of 2023, the share of new talent was down nine points compared to 2022, with only 54% of new contracts signed during the year relating to new talent (compared to 88% in 2022, -34 points year-on-year). For Stéphane Berlow, Managing Director of Kobalt France, the decline in the signing of new talent reflects “the difficulty to bring out new talent and the uncertainty in investing in new talent.”

Overall, the number of publishing contracts reached 4,652 at the end of December 2023, up 10% compared to 2022. This increase is mainly due to growth in management and administration contracts (up 53%) and co-publishing contracts (up 22.5%).

Publishers paid authors and composers almost €82m in advances in 2023, a 41.5% increase compared to 2022. The advances were split between established authors (+59%) and, to a lesser extent, emerging talents (+13%), which represented 29% of total advances paid by publishers in 2023, compared to 41% for established authors.

A 4.4 points growth in NPS

Advances related to management and admin contracts also increased significantly (+31%). Finally, advances related to exports (sub-publishing) have increased almost sixfold over the past year, reaching €2m in 2023. However, they only represent 6% of total advances.

Finally, CSDEM calculated that its members’ Net Publishers’ Share (NPS) has grown by 4.4 points between 2022 and 2023 to 37.4%, a level higher than in 2019, but slightly lower than in 2020. “After years of decline, NPS has recovered in 2023,” said Berlow.

NPS and revenue has increased more significantly in the case of publishers with revenues exceeding €10 million, with NPS up 25% and revenue up 22.3%. Meanwhile publishers with revenues between €1m and €10m saw their average revenue increase by 6.9% and their NPS by 5.9%, while companies revenues between €250,000 and €1m saw their average revenue and NPS decrease by 2.7%. Finally, companies generating less than €250,000in yearly revenues saw their average revenue collapse by 10.3%, while their NPS rate declined by.3% year-on-year.

Optimising figures

CSDEM’s Director Sophie Waldteufel commented: “Music publishing is not always understood and this his report is very important for us. It helps us explain who we are and what we do. We have as many profiles and economic models as we have members. so each year we try to strengthen the report and optimise our figures.”

The report is a joint effort between the CSDEM, which represents 150 music publishers of pop music and is recognised as a representative body by the Ministry of Labour in France; the CEMF (Chambre Syndicale des Éditeurs de Musique de France of Music Publishers of France), founded in 1873 and representing publishers of classical music, and ULM (Union des Librairies Musicales or Production Music Organisation), founded in 2000, with a membership including publishers and producers of repertoires intended for inclusion in audio-visual content. ULM has 18 members, made up of independent companies and divisions of major companies (Universal Music Publishing Group, Sony Music Publishing, Warner Chappell Music, and BMG).

CSDEM’s report is compiled by consultancy firm Xerfi, and is based on a survey sent to CSEDEM, CEMF and ULM members. Respondents included 691 companies represented by 47 entities, accounting for 68.6% of the rights distributed to publisher sin 2023.

Majors’ share at 42%

Publishers represented in the sample generated an average turnover of €7.5m in 2023, for a median turnover of €610,000. On the other hand, 63% of them generated a turnover of less than €1m, of which almost a third generated a turnover of less than €250,000. Based on SACEM data, the majors, defined as publishers generating more than €10m in turnover, represented 42% of SACEM distributions to publishers in 2023, a percentage increase of three points compared to 2022.

(Picture under license from AdobeStock)

Creative Industries

Gabriel Prokofiev signs global publishing agreement with Chester Music

Creative Industries

Avex Music Group signs Kamal Wilson to a global publishing agreement

Creative Industries

Concord Music Publishing ANZ signs The Belair Lip Bombs to a global publishing deal

-

Collective Management Organisations3 years ago

Collective Management Organisations3 years agoThe MLC plans webinars to show members how to use tools to manage song data

-

Collective Management Organisations3 years ago

Collective Management Organisations3 years agoCécile Rap-Veber (SACEM): ‘We are a solutions provider to create value, a tech company, and we are less and less seen as some sort of cultural institution’

-

Collective Management Organisations3 years ago

Collective Management Organisations3 years agoAndrea C Martin (PRS for Music): ‘In 2022, we will have higher revenues and we will pay out more royalties to our members’

-

Interview4 years ago

Interview4 years agoOlivier Chastan (Iconoclast): ‘Name, image and likeness will be as important as music rights in the future’