Creative Industries

France’s music publishing business grew by 7% to an all time high of €418m in 2022

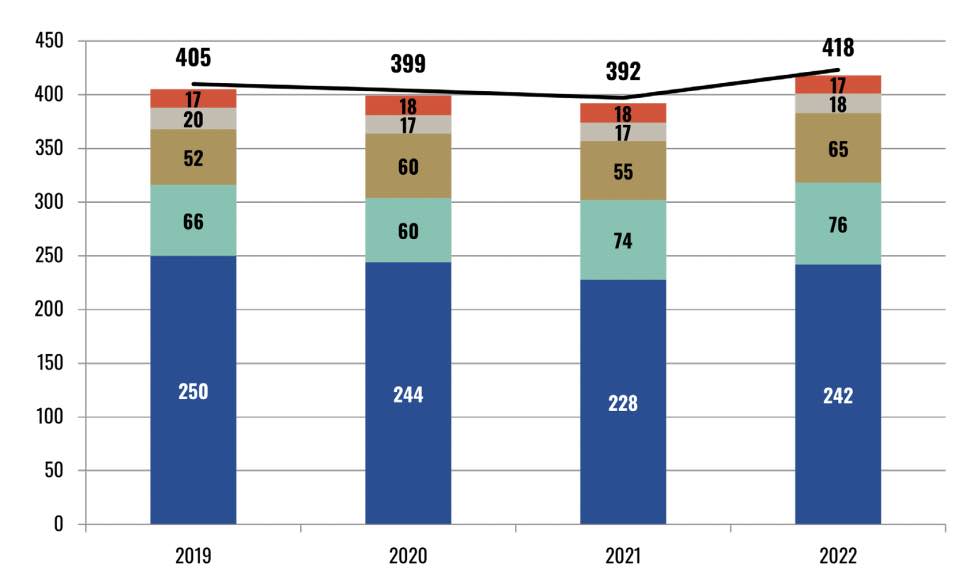

The music publishing market in France has posted record revenues of €418 million in 2022, up 7% compared to 2021, and above the €405m recorded in 2019, before the Covid pandemic, according to the yearly ‘Focus on Music Publishing in France 2022′, published by music publishers’ associations CSDEM (pop repertoire), CEMF (classical repertoire) and ULM (production music).

The set of figures produced by CSDEM are unique in the world in that they map out as granularly as possible the state of the music publishing sector in France. The report is based on 2022 data compiled by research company Xerfi, with a panel of 44 respondents, representing a total of 716 companies (against 642 companies a year before), representing 68.3% of the total rights distributed by France music rights society SACEM (against 63% a year prior).

Juliette Metz, President of CSDEM and CEO of music publishing company Encore Merci, said the 2022 figures still reflected the impact of the Covid crisis, but also pictured a publishing sector coming out of the pandemic with dynamism.

Make a case with policy-makers

Metz, who was speaking at the presentation of the report in Paris, said that the yearly figures’ compilation was a key component that helped the music publishing sector get on the map with policy-makers and provide an accurate picture of the local business.

Metz said having a clear mapping of the publishing sector helped in France helped make a case with the government and policy-makers to get a legislation introducing in 2023.a tax credit for music publishers.

While 2021 figures reflected the full impact of the pandemic, 2022 data shows a completely different picture with all segments posting growth, noted Anne Jouanneau, President of CSDEM’s research committee and deputy Managing Director at Sony Music Publishing, during a presentation of the study in Paris.

Reaching historic levels

“After two years of decline, we have reached historic levels at €418m,” said Jouanneau. “All segments performed well, from public performance and collections going through [music rights society] SACEM to synch, export and classical.”

Domestic repertoire accounted for 41% of total revenues, up 20% compared to 2021, with new talent accounting for 22% of local revenues, down four percentage points year-on-year. However, domestic repertoire accounted for 69% of French music publishers’ NPS (net publishers’ share or gross margin)., up four percentage points compared to the year prior.

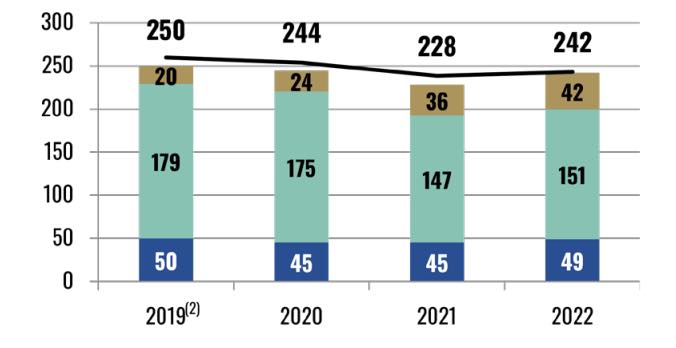

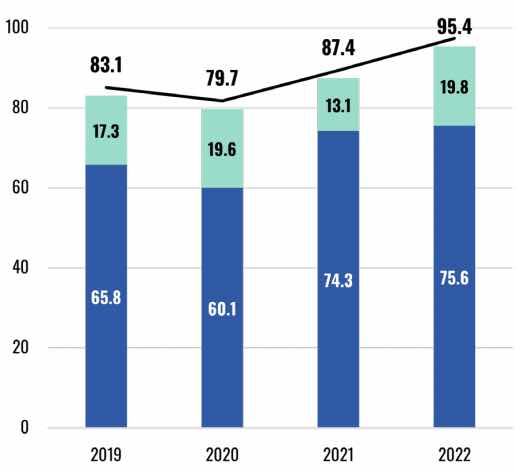

SACEM revenues accounted for €242m, up 6% year-over-year, and were the single largest source of revenue for music publishers, followed by synch at €76m, up 2%, foreign rights going through the network of sub-publishers at €65m, up 19%, classical music rights at €18m, up 8% and other rights (reprography licenses, neighbouring rights), slightly down 1% to €17m.

Lower digital revenues

SACEM distributions accounted for 58% of publishers’ total revenue in 2022, down five percentage points since 2018, and also 3% lower than in 2019 in value. Sync rights collected directly by publishers represented 18% of the total, up one percentage point in four years, and up 9% year-over-year, thanks mainly to international sync rights at €19.8m, up from €13.1m a year prior.

CSDEM noted that the growth in digital revenues collected by SACEM (+10%) was not fully reflected in the CSDEM figures (+6%) because of the pan-European deals made by the major publishing companies and some of the biggest independent publishers that divert these revenues from the French affiliates of these companies.

Digital revenues only represent 17% of total revenues for publishers in France, when it represented 37% of SACEM’s income. Total digital rights paid to publishers reached €102.4m in 2022, but only €57.8m were collected directly by France-based publishers, while €44.6m was paid to the parent companies of major publishers as part of the pan-European deals with DSPs.

Increase in performance rights

“This situation creates a discrepancy between music publishers’ share of revenues from digital and what the recorded music side of the business receives from digital sources,” said Stéphane Berlow, CEO of Kobalt France. “These rights represent more than €100m, but local publishers only collect a portion of it.”

CSDEM noted that digital rights from platforms such as YouTube, Facebook, Instagram and TikTok and others were “very low, if not borderline non-existent.”

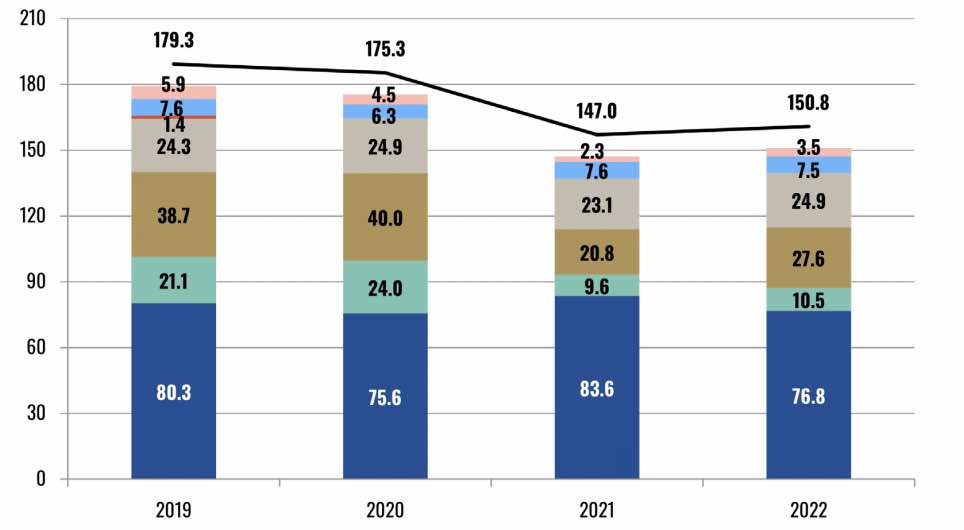

Meanwhile, public performance rights, which represented 63% of the rights paid to publishers, grew by 3% in 2022, thanks to good results from cinema (+50%), music in public space (+33%) and live music (+9%). Despite high growth levels, this segment has not yet reached pre-Covid levels. Revenues from radio were up 8% while TV revenues were down 9% year-on-year. Foreign rights were up 14% compared to 2012 at €11m.

Growing international income

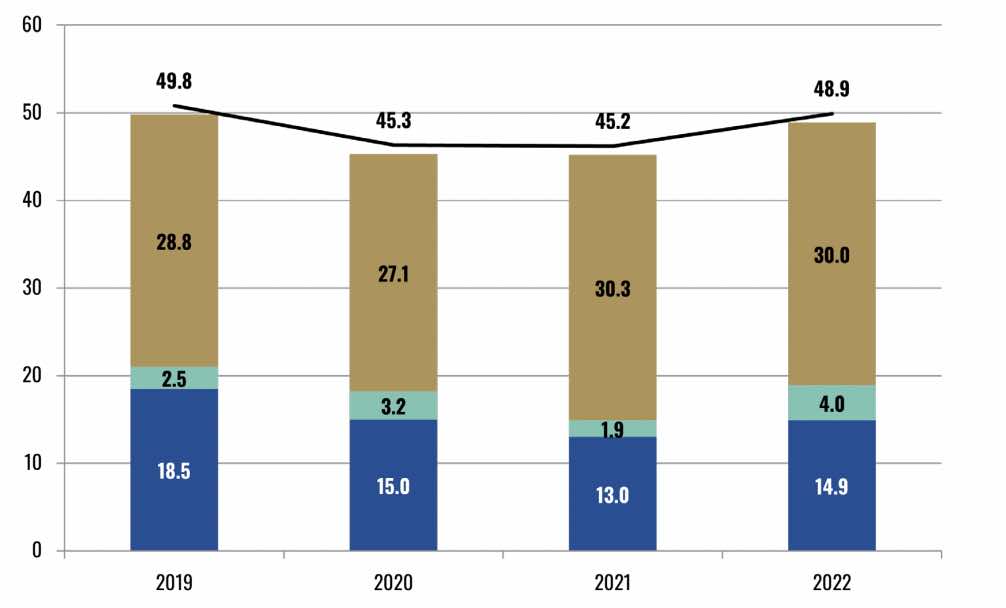

Mechanical rights, collected by SDRM, reached €49m in 2022, up 8% year-on-year, thanks to an increase in revenues from physical sales and export. The proceeds from private copying, which account for 61% of mechanical rights, were stable at €30.3m.

International revenues coming from the global network of sub-publishers reached €65.1m, up 19% compared to 2021, and accounted for 16% of the total, up four percentage points since 2018. All categories of international rights posted grow, in particular sync and performance rights. The Pop repertoire accounted for 74% of international rights, with production music at 23% and classical at 3%.

At €95.4m, sync revenues were up 9% and reached an all-time high. The bulk of the increase comes from international sync rights, up 51% year-on-year, when domestic sync rights only grew by 2%. Sync revenues generate din France accounted for 70% of total sync income with international accounting for 30%.

Classical market back on tracks

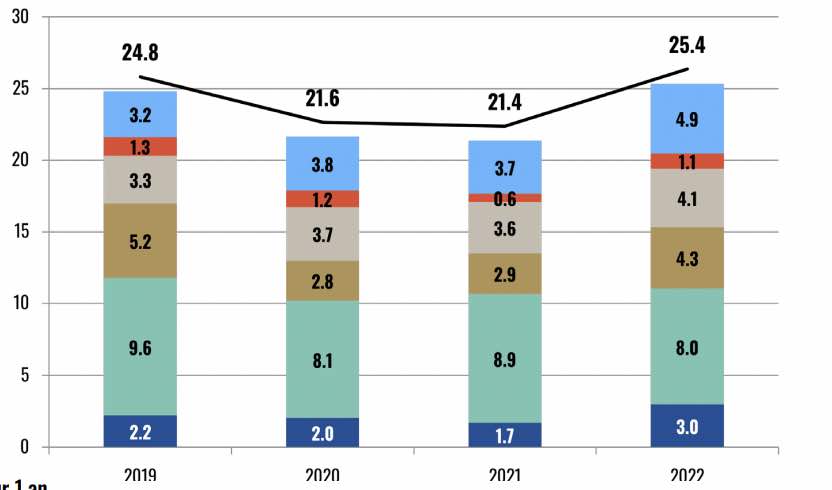

Other rights (mainly reprographic and neighbouring rights) accounted for 4% of the total and specific rights to classical music for 4% too. The classical market had revenues of €25m, up 19% over the previous year. Reprography and sync rights accounted for 49.2% of revenues, SACEM distributions for 29.6% and rental and grand rights for 21.2%.

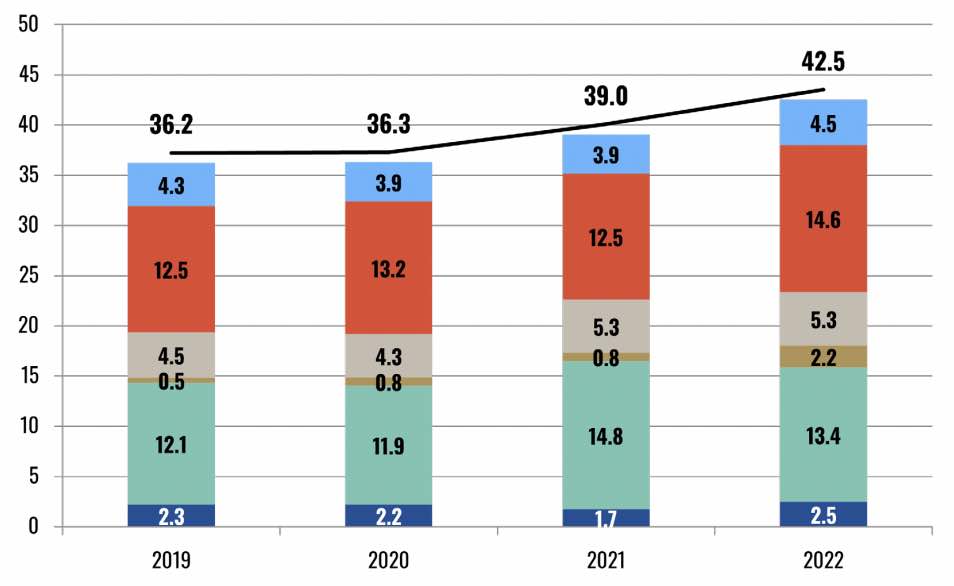

Production music revenues reached €42.5m, up 9% year-on-year, thanks to a significant growth in digital rights and international rights and other rights. Public performance rights, in particular income from the use of music on TV, were down 9% compared to 2021, while sync rights were stable.

According to the CSDEM survey, 61% of the companies had revenues under €1m, with 25% with revenues between €1m and €10m, and 13.6% with revenues over €10m. Publishing companies employed 376 people, up 3% year-over-year, with 54% being female.

Strength of local repertoire

“In the aftermath of the Covid pandemic, there’s three ways companies have responded,” explained Bruno Lion, MD of peermusic France. “There’s those who suffered from Covid, with a 20-25% drop in revenues due to their reliance on live and public performances; those who had stable revenues, thanks to a good performance from TV and radio and the strength of private copying revenues; and those whose revenues went up thanks to the above and good revenues from international and digital.”

Domestic repertoire accounted for 41% of total revenues, down four percentage points year-on-year, but up 20% in value. New talent accounted for 22% of the revenues generated by local repertoire. New works registered by publishers in France reached 27,519 in 2022, up 17% year-on-year, of which 12,956 were from new talent.

The total number of local works published has significantly grown in 2022 — up 6% compared to 2021, to 856,437 works — and up 46% compared to 2019. There were 28,000 new titles registered in 2022, up 17% year-on-year, thanks mostly from a 39% increase in new works from established songwriters. Jouanneau said there was significant growth in the number of registered works but the average revenue per work has declined.

Advances up 9% to €77m

The average revenue per work increased by 2% between 2021 and 2022 for all works (French and foreign works combined) and 12% over the same period for local works. However, this average income per work still remains behind compared to its 2019 level, by 21% for all works and 22% for local works.

In 2022, French publishers have signed 1,390 new contracts, up 11% compared to a year prior, of which 1,087 were with new talent, whichh represented 78% of new contracts during the year. In terms of music genres, 628 contracts were signed with Urban songwriters, 448 in Pop, 138 in Electronic/EDM, 88 in Rock and 29 in Jazz.

French publishers have invested €77m in advances to songwriters and composers, up 9% year-on-year, of which 36% went to new talent, reflecting the publisher’s continuous investment in up-and-coming talent.

A global focus on music publishing underway

The CSDEM figures show that major companies accounted for 39% of the market with independent publishers grabbing a 61% share, a stable figure year-over-year.

At the end of the CSDEM presentation, Nicolas Galibert, President of Sony Music Publishing France, updated French publishers on the initiative taken by global music publishing trade body ICMP (International Confederation of Music Publishers), to replicate the French data collection system at a global level to provide a comprehensive and .granular tool about the music publishing sector.

“The first global focus on music publishing is underway,” said Galibert, who coordinates this project on behalf on ICMP. “We have sent a survey to all the music publishers’ associations in the world to start compiling this data.” ICMP has contracted with research company GC Partners as a trusted third party entity to collect and process data from publishers.

An advocacy tool

“It’s a major undertaking,” he added. “We are asking publishers to provide us with 12 months of financial data. It’s a massive data collection effort.” Once completed, Galibert expects the set of data to sit alongside the annual global reports from the IFPI for recorded music and CISAC for global collections.

“It will be a crucial tool for us when we meet with policy-makers in Brussels or at WIPO in Geneva,” said Galibert. “Imagine if you have in one document the revenues of the sector, how many people we employ, etc. This could turn into a fundamental tool to advocate for a tax credit scheme at a European level.”

Creative Industries

IMPALA’s AGM and inaugural European Independent Music Summit in Zagreb focus on priorities for the independent sector

Creative Industries

Kobalt and umn Entertainment acquire publishing and writers’ rights to Peter Plate and Ulf Leo Sommer’s catalogue

Creative Industries

Dan Rosen appointed President of Warner Music Australasia & Southeast Asia

-

Collective Management Organisations3 years ago

Collective Management Organisations3 years agoThe MLC plans webinars to show members how to use tools to manage song data

-

Collective Management Organisations4 years ago

Collective Management Organisations4 years agoCécile Rap-Veber (SACEM): ‘We are a solutions provider to create value, a tech company, and we are less and less seen as some sort of cultural institution’

-

Interview4 years ago

Interview4 years agoOlivier Chastan (Iconoclast): ‘Name, image and likeness will be as important as music rights in the future’

-

Collective Management Organisations4 years ago

Collective Management Organisations4 years agoAndrea C Martin (PRS for Music): ‘In 2022, we will have higher revenues and we will pay out more royalties to our members’